Unemployment insurance tax calculator

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information. SUI Rate or State Unemployment Insurance Rate is a employer-funded tax that gives short-term benefits to those who lost or left their jobs for a variety of reasons.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Your UI tax rate is applied to the taxable.

. The maximum amount of taxable wages per. The 2017 federal unemployment tax is 6 of the first 7000 you pay in wages to an employee. File Wage Reports Pay Your Unemployment Taxes Online.

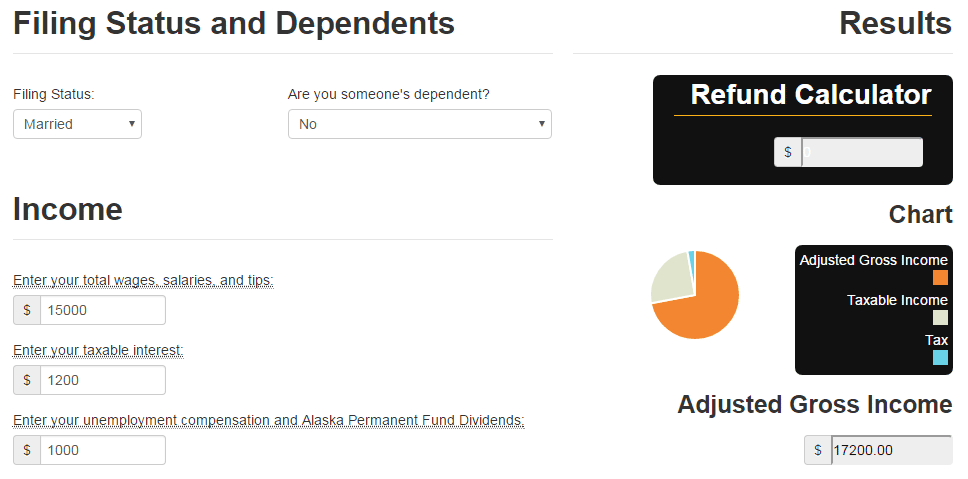

2 This amount would be reported on the appropriate reporting form. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate. This rate calculator is intended solely for estimation purposes only.

State Unemployment Insurance Calculator Maintaining an active approach to State Unemployment Insurance SUI tax rates can help ensure you are not only compliant but not. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Premium federal filing is 100 free with no upgrades for premium taxes.

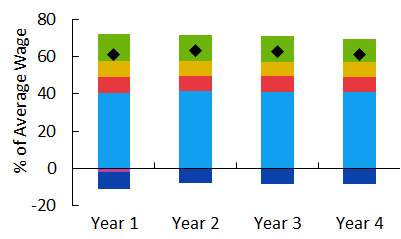

1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter. The federal unemployment taxes paid to the Internal Revenue Service Form IRS 940 are used to pay the costs of administration of the unemployment insurance and Job Service programs in. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The SUTA tax funds state unemployment insurance for employees who have lost their jobs. Weekly Benefit Rate Calculator. Youll need to understand.

Get an estimate of your Unemployment Insurance Weekly Benefit Rate should you become unemployed. Discover Helpful Information And Resources On Taxes From AARP. If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a.

Arizona uses a reserve ratio system to determine the tax rates. Ad Our Resources Can Help You Decide Between Taxable Vs. Its a progressive tax.

Weekly Benefit Rate Calculator. Ad Smart Technology Easy Steps User Friendly - 48 Star Loyal Customer Rating. If youve paid the state unemployment taxes you can take a credit of up to 54.

If you earn more you pay a bigger percentage of your income. This taxable wage base is 62500 in 2022. If you earn less than 10347 per year you dont pay income tax.

Simply enter the calendar year your premium. Your SUTA payment is based on your states wage base and tax rate. This tax rate is determined by dividing the total unemployment benefits paid to former employees by the total taxable wages paid to all their employees.

In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer. Employee 3 has 37100 in eligible. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

Refer to Reporting Requirements. Access Insights On Retirement Concerns The Impact Of Taxes. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums. Your actual rate will be determined in mid-March and a Contribution Rate Notice will be.

Payroll Paycheck Calculator Wave

Tax Benefit Web Calculator Oecd

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Futa Tax Overview How It Works How To Calculate

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Jquery Tax Calculator Plug In For Financial Websites

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Payroll Tax Calculator For Employers Gusto

Tax Calculator For Income Unemployment Taxes Estimate

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Tax Calculator For Income Unemployment Taxes Estimate

Unemployment Insurance Rate Information Department Of Labor

Federal Income Tax Calculator Atlantic Union Bank

How To Calculate Unemployment Tax Futa Dummies

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies